Every year, about this time, many taxpayers, eager to receive their large refunds and not wanting to wait until they receive their W-2′s from their employer, decide to move forward with filing their return by using their last pay stub of the year. Is this legal? Well, I’ve addressed the issue of a paid tax preparer filing someone’s return without a W-2. And, they clearly are not suppose to do that.

But, what about filing your own return? There are obviously issues with that as well as I’ve addressed in the same article above. However, the difference is, it is against the rules for a paid preparer to do it, but someone filing their own return could just run into some accuracy problems. It isn’t necessarily illegal or against the “rules” for someone to file their own return with their last pay stub.

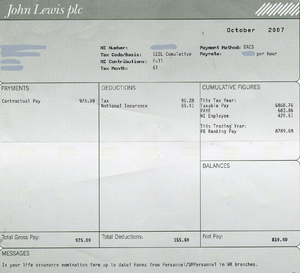

When you file a return, you are swearing under oath that the income that you have listed on the return is accurate and complete. Whether you got that information from a W-2 or a pay stub shouldn’t matter, as long as you are 100% sure that it is correct. So, technically, yes, you could file your own return with your last pay stub.

Filed under: Personal Taxes Tagged: Filing, Internal Revenue Service, IRS tax forms, last, pay stub, Paycheck, paystub, Tax, Tax preparation, tax return